This is Part 5 (and the final part) of Jon Fougner’s guest series on Cinema Profitablility – today he concludes the discussion of marketing as well as margins.

Marketing Continued:

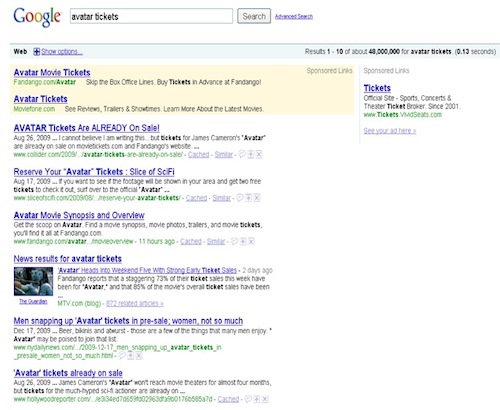

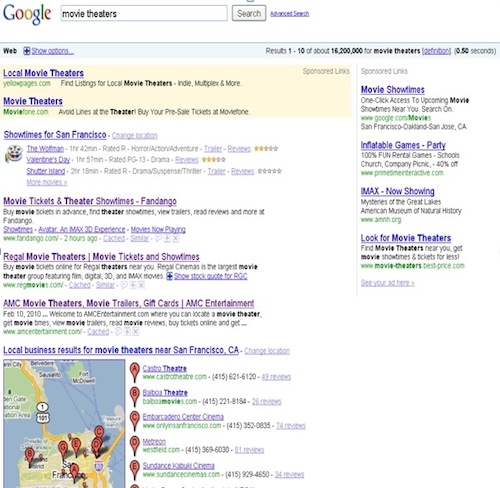

Once the site is in good shape, let’s get people to it. Today, a user may be unlikely to find the website in the first place, since none of the Big 3 has successfully SEO’ed its site for current releases (e.g, searching for “Wolfman showtimes” on Google). One side benefit of the affiliate program described above will be improved search rankings for this common and valuable query type, since affiliates will be linking to the site. Besides common sense, the reason for optimism that each of the Big 3 should be able to get above-the-fold on Page 1 of search results is that the bar has been set low; here’s the above-the-fold part of the Google SERP for “avatar tickets” from a San Francisco area IP address on 1/17/2010:

In the organic results above, Movietickets.com and the Big 3 are MIA, and Fandango is getting beaten by 2 less relevant sites. In addition to such “universal organic” SEO, the Big 3’s sites should optimize for the increasing array of data type-specific search results modules, most notably, showtimes and local.

Google’s showtimes module exemplifies the importance of offering publishers an appealing, open affiliate program; Google hyperlinks Fandango showtimes, but not Movietickets.com. When a consumer is looking at movie showtimes, only some of which are hyperlinked to a POS, I suspect that he often believes that the non-hyperlinked times are not available for sale online anywhere6. Therefore, when he values pre-ordering (i.e., when he anticipates a sell-out), non-hyperlinked theaters will suffer. I anticipate that Google’s showtimes module will gain adoption, as a clean alternative to the cluttered UIs of the online brokers. Therefore, with respect to the Big 3, barring a private affiliate deal between Google and Movietickets.com, I believe that AMC’s Loews will lose pre-order market share.

The Big 3’s core customers are Facebook users. For any of the Big 3, creating a Facebook Page for each theater offers a free re-marketing channel for both brand and direct response. Even if it already has a “master” Page run by corporate, it’s worth trying localized Pages as well, since the share of user attention that (say) Regal could command is not fixed: users can fan both a national Page and a local Page. These could be managed centrally, via a 3rd party Page management dashboard, or locally by the theater manager (with assets and guidance from HQ). Giving many local teams a chance to shine in friendly competition with one another will engage employees’ creativity and help best practices bubble to the top. Two easy ways customers can connect to a Page for (say) Alamo Drafthouse Cinema are:

• visit facebook.com/alamodrafthouse, or

• text “like alamodrafthouse” to 32665 (“FBOOK”), Facebook’s U.S. short code.

As the Harvard Business Review pointed out in an article demonstrating the loyalty value of Facebook Pages, one should avoid “if you build it, they will come” thinking; most of your customers aren’t yet your fans on Facebook. It’s key for a given cinema to present the opportunity to connect when the consumer is enjoying its products. For instance, these two methods to connect could be publicized on:

• marquees,

• ticket stubs,

• receipts,

• concession packaging,

• and pre-trailer ads.

What’s more, when these consumers connect with the Page, their friends will learn about it and have the opportunity to connect as well. Turning these fans into repeat customers hinges on direct response best practices. The linchpin, of course, is experimentation. Facebook shares advice and updates regarding Facebook Pages, Facebook Ads, and brand marketing.

Once a Facebook strategy is humming along, it may be worth trial-and-error forays into other leading social media platforms, most notably, Yelp, YouTube, and Twitter. The proliferation of UGC (including negative reviews) across these and other sites is spurring a reputation management industry serving frustrated local business owners; Marchex is emerging as an early leader. Besides outbound marketing, these tools can help identify which locations and employees are undermining the brand promise of customer service.

Margins

Most of the commonly suggested concessions ideas forget that the food gross margin is already heroic. Even alcohol is not a slam-dunk, since its gross profit per sale won’t be much more than soda; I believe that the main benefit would be to increase the overall beverage sell-through rate (albeit at increased costs7).

I believe that the most effective strategy to improve the ticketing gross margin is to demonstrate to the studios that one has profitable alternatives to their products, as described above. Perhaps counter-intuitively, a given Big 3 player would want his 2 peers –against whom he bids for films — also to discover these profitable alternatives, so that their demand for studio product is similarly attenuated.

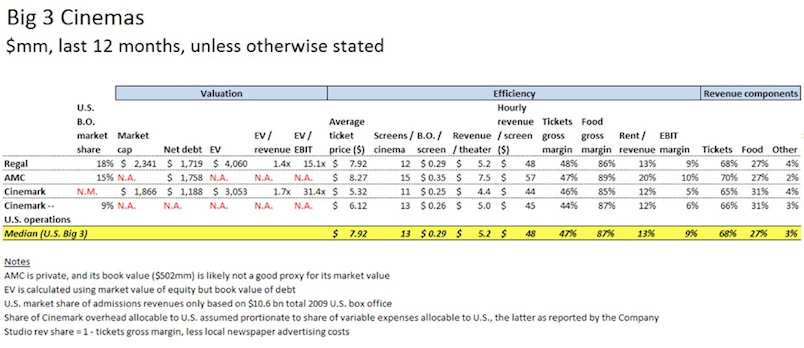

AMC has decided to invest in large theaters in highly trafficked neighborhoods of dense population centers. I believe that its industry-leading average ticket price, box office per screen, and revenue per theater are a result of this decision. (Increasingly, in the future, the fraction of screens that are 3D and IMAX will influence these KPIs more than they did pre-Avatar.) I believe that cinemas tend to be anchor tenants, bringing customers to nearby restaurants and shops. They should try to internalize those positive externalities in the form of subsidies from their landlords and/or local governments.

What’s Next

I continue to believe that digital and 3D are the most important near-term innovations for the Big 3. Avatar’s $2.6bn worldwide take will accelerate DCIP’s roll-out. Next highest on the strategic priority list, I’d:

• Unfetter (contractually and game theoretically) from restrictive relationships with content vendors, ticket brokers, and their own consortia (DCIP and National Cinemedia)

• With that increased runway, relentlessly experiment, like a technology company

• Invest at least $10mm annually in Internet marketing, not including paid media

If they can move fast, they might just keep seeing us at the movies.

Footnotes

6 Since these links are not labeled as sponsored but are, in effect, sponsored by Google itself, I would not be surprised to see Google, in the interest of organizing the world’s information and making it universally accessible and useful, hyperlink even showtimes that do not offer affiliate commissions.

7 These costs may be high. They include explicit cash costs (alcohol licenses, janitorial, insurance, etc.) as well as implicit costs of undermining the customer experience for those distracted by their fellow customers. That latter risk will be particularly acute if the service model is as casual as at baseball parks.

— Jon Fougner

Jon leads local product marketing and monetization at Facebook, working with the advertising engineers and product managers to build products for local businesses, ranging from restaurants to movie theaters.