Today’s guest post is Part 2 of Jon Fougner’s guest series on Cinema Profitablility – today he focuses on the products that cinemas offer:

Products

Cinemas’ suppliers have leveraged the proliferation of alternative retailers for their products: DVD, cable, VOD, Netflix, iTunes, Hulu, and more. Cinemas, meanwhile, have barely experimented with sourcing alternative product. The result is an oligopoly5 (the studios) selling to a captive market (the cinemas), a game theoretical nightmare for the buyers, even if they are an oligopoly of their own. That translates to a 55% revenue share back to the studios on tickets. (The other half of gross profit comes from food, sold at an 85% gross margin.) And the theaters know it could get worse, as more films go day-and-date or nearly so.

The good news is that the pending deployment of digital projection will reduce the fixed cost of showing a given product on a given screen to nearly zero. Without having to recoup the cost of manufacturing and shipping a physical print, it’s economically feasible to experiment with niche content that you might exhibit only a few times. Translation: the cinemas can throw scores of more tests against the wall, and arrive at an equilibrium with a greater diversity of content.

Many industry watchers would not have predicted that the digital broadcasting of the Met would have done so well. Let’s try other marquee fine arts (Broadway plays and musicals, ballets, etc.), live sports (Olympics, pro sports, NCAA, etc.), prime-time network TV, other films (classics, independents, etc.), even university lectures. My personal favorite: content with built-in intermissions, so patrons go to concessions during the breaks. Since these productions’ cost structures are already supported by existing revenue streams, and the marginal cost of adding cinema distribution is low, their producers’ negotiating leverage should be low.

Although channel-partnering with cinemas is an obvious win for the Met, since the geographical constraints of its audience means it doesn’t have to fear cannibalization, TV execs might hesitate longer. However, it becomes a no-brainer for even them if the cinemas are willing to show their ads — which makes more sense than relying on National Cinemedia, since the TV ad market enjoys so much more liquidity. Many of these alternative content trials will fail. For instance, competing with sports bars without selling alcohol may be a tough sell. That’s fine. Only keep the winners.

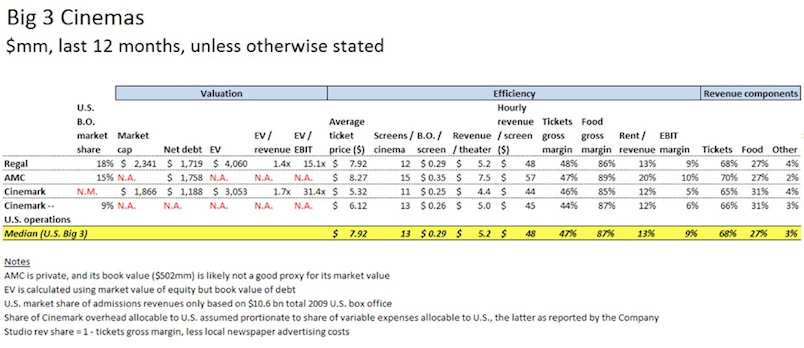

A skeptic might ask: isn’t there a big opportunity cost of borrowing a screen from first-run films to test these alternatives? The Big 3’s screens gross only $44 – $57 / hour (including concessions), or about $100 / hour if you count only noon to midnight. At $7.50 ticket revenue plus $3.50 food revenue per patron, that’s an average of just 20 butts in seats during operating hours (estimating that screenings average two hours apiece). At a wild guess of 200 seats / screen, about 90% of inventory is wasted. During daytime and weekdays, wastage is obviously highest, so these periods are ripest for experimentation. In order to maximize combined profits of the content producers and exhibitors, I suspect that it’s optimal to lower ticket prices for some of this alternative content, since the concessions gross margins are so lucrative. (To do that mental exercise, pretend you are CEO of a holdco that owns both the content developers and the exhibitors, so the content rev share is a wash to your bottom line.) The trouble is, to get to that Pareto-efficient outcome, I bet that the content owners would turn the conversation to revenue-sharing the concessions, which I imagine would make the exhibitors’ heads explode. Rev sharing the concessions is unnecessary to make this work, since there’s so much admissions gross profit being left on the table.

I hope but am led to doubt that each of the Big 3 has built a detailed, quantitative model projecting the total revenue stream of each picture it evaluates for rent. Back in 2006, Malcolm Gladwell was enamored of the team at Epagogix working on this problem. More recently, on the production side, Ryan Kavanaugh has become one of Hollywood’s fastest rising moguls, in large part through his number crunching acumen. (Now even amateur B.O. modelers can put their money where their mouth is, via the “Hollywood Stock Exchange“.) The models are often set up as complex regressions whose right-hand side variables include genre, format, release date, actors, directors, studio marketing budgets, and so on. One risk with such models is that they be over-fit, due to the large number of RHS variables and wealth of historical data. Their analytical approach is typically not experimental, since they don’t have the levers to run the experiments.

Averaging 5,000 screens across 400 cinemas, each Big 3 chain has the luxury of being able to run controlled experiments. For instance, suppose Regal is evaluating two prospective titles, Picture A and Picture B, each of which it projects to gross $20k per screen over its run of April 1 to May 1. It could randomly assign each of its theaters to bid on either A or B, and then look for statistically significant differences in the total revenues of Picture A and Picture B theaters. Besides direct revenue from A and B ticket sales, such an approach would capture indirect effects, such as cannibalization, sell-out spillover, and concessions. (Once most transactions are tied to a specific customer (see below), it will be possible to directly measure such effects: e.g., hypothetically, each “Transformers 3” ticket might generate 1.5x the concessions sales of a “White Ribbon” ticket.) The same experimental design could also be applied to other proposed products, such as new concessions.

So there’s a science here, but there’s also an art — just ask Tim League. His Alamo Drafthouse chain in and around Austin, TX is one of the highest revenue-per-seat cinemas in the United States. Tim has built loyal communities around his theaters, which are the social anchors of their neighborhoods. Revelers pack the house for singalongs, “quote-alongs”, film festivals and more. And they gorge on good food and alcohol. Does it help to be in a college town that’s an anchor of the independent film movement? Of course. Is Tim’s the most profitable theater, per screen, in the country? Maybe not — his costs are high, too. But I’m told that Tim is getting offers to franchise around the country. And if I were one of the Big 3, I’d sweat that.

Assigned seats. Real food. Alcohol. Ticket stub ad inventory for local restaurants’ coupons. Video game tournaments. Subscription products (“Monday Night Comedies”, etc.). Demographic-targeted titles that follow the Netflix rental maps. Ancillary revenue streams akin to how Live Nation makes its gross margin: “VIP” access and film-specific merchandise and media (not necessarily fulfilled on-site). We’ve seen small pilots of some of these. AMC has even promised its lenders some innovations. Which of these products can be meaningfully accretive to margins at scale? We’ll never know, at least not until one of the Big 3 conducts a good ol’ fashioned experiment.

Notes:

5 I say “oligopoly” in the game theoretical, as opposed to legal, sense.

END OF PART Two Tomorrow: Channels

— Jon Fougner

Jon leads local product marketing and monetization at Facebook, working with the advertising engineers and product managers to build products for local businesses, ranging from restaurants to movie theaters.